Nyanzaga Gold Project

The Nyanzaga Gold Project (Nyanzaga or Project) is an advanced development project in

The Project comprises the Special Mining Licence (SML) which covers 23.4km2 and encompasses the Nyanzaga and Kilimani deposits and other exploration prospects. In accordance with the Tanzanian Mining Act, the Government of Tanzania holds a 16% free-carried interest in Sotta Mining Corporation Limited, a subsidiary of OreCorp Limited and the holder of the SML. There are also a number of prospecting licences and applications surrounding the SML.

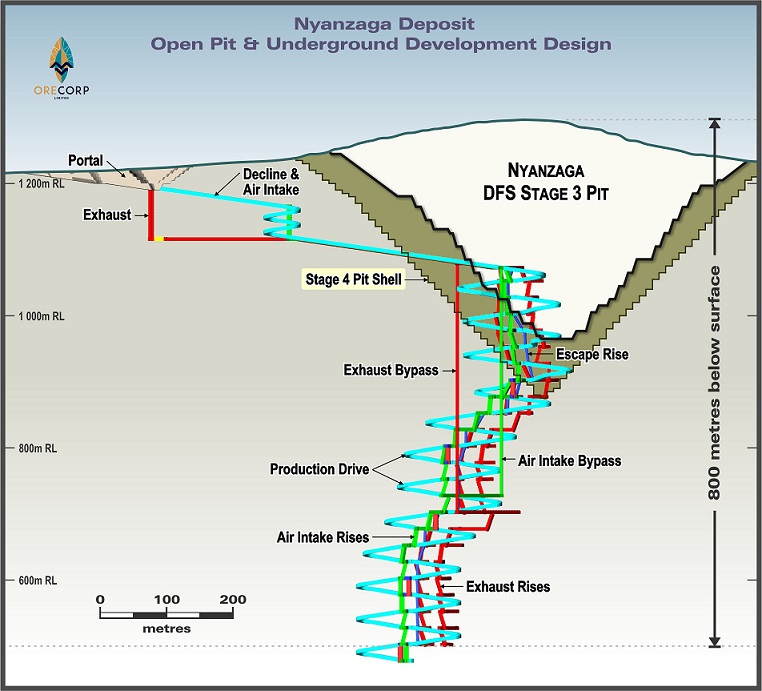

The Company has completed a Definitive Feasibility Study (DFS) for the Project which outlined the development case for a 4 Mtpa concurrent open pit and underground mining operation over a 10.7 year Life of Mine (LOM).

Highlights of the DFS are;

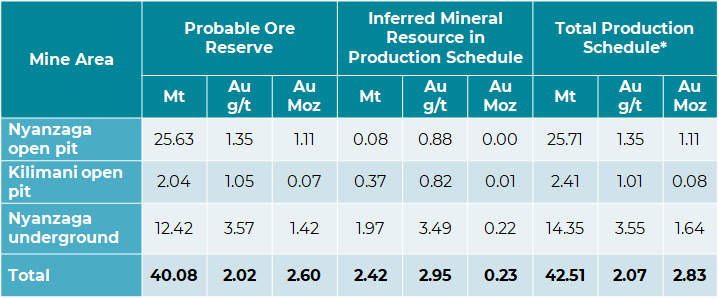

- Maiden Probable Ore Reserve (at US$1,500/oz) of 40.08 Mt @ 2.02 g/t gold for 2.60 Mozs.

- Combined open pit and underground production target of 42.51 Mt @ 2.07 g/t gold for 2.83 Moz contained gold, comprising the Probable Ore Reserve plus Inferred Mineral Resources of 2.39 Mt at 2.98 g/t for 0.23 Moz contained gold. The production target comprises 92% Probable Ore Reserves and 8% Inferred Mineral Resources. There is a low level of geological confidence associated with Inferred Mineral Resources, and there is no certainty that further exploration work will result in the determination of Indicated Mineral Resources or that the production target itself will be realised.

- Peak gold production of 295 koz/pa; averaging 250 koz pa for the first eight years; 242 koz pa for the first ten years

- LOM average gold production of 234 koz pa over 10.7 years

- Pre-production capital cost of US$474M includes underground development, open pit pre-strip, plant and associated project infrastructure and US$36M contingency

- High margin project with low all-in sustaining cost (AISC) of US$954/oz

- Pre-tax NPV5% of US$926M and IRR of 31%; post-tax NPV5% of US$618M and IRR of 25% based on a US$1,750/oz gold price

- Short payback period of 3.7 years (post-tax)

- Open pits are scheduled to deliver 1.2 Moz at 1.32 g/t gold and a low 3.7:1 (waste: ore) strip ratio using an average weighted lower cut-off grade of 0.48 g/t gold

- Underground mining is scheduled to deliver 1.64 Moz (including underground development material) at 3.55 g/t gold using an average weighted lower cut-off grade of 2.0 g/t gold

- Underground to be developed to a depth of 700m below surface; deposit remains open at depth

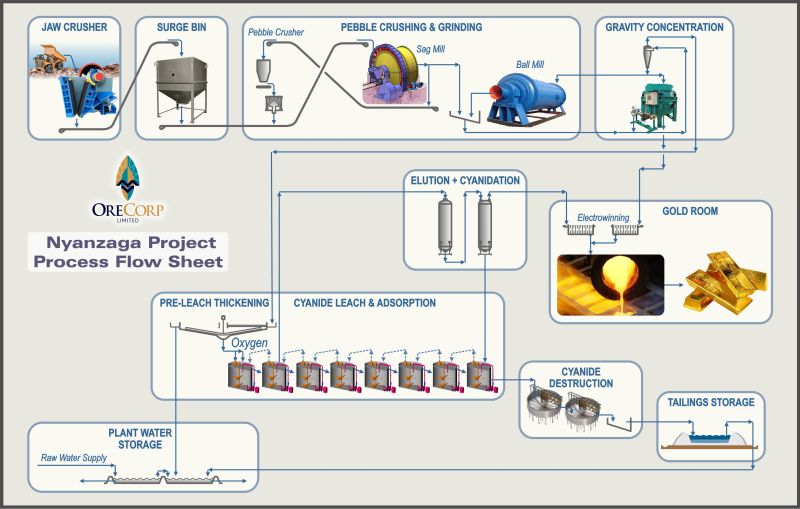

- Detailed DFS metallurgical test work confirmed average LOM gold recovery of 88% through a conventional 4 Mtpa Carbon in Leach (CIL) processing plant

The classified Ore Reserve estimate for the Project comprises three distinct operations:

- Nyanzaga open pit

- Nyanzaga underground

- Kilimani open pit

The combined Probable Ore Reserve is 40.08 Mt at 2.02 g/t Au for 2.60 Moz. The production schedule of 42.51 Mt @ 2.07 g/t gold for 2.83 Moz contained gold, comprising the Probable Ore Reserve plus Inferred Mineral Resources of 2.42 Mt at 2.95 g/t for 0.23 Moz contained gold.

Processing of Nyanzaga ore will be by a conventional 4 Mtpa SABC with carbon in leach (CIL) treatment route. The material will be ground to 80% passing 75 microns. The average LOM gold recovery is 88%.

Image Gallery